HEALTH & BEAUTY - THE THING SMALL BRANDS DO WELL THAT BIG BRANDS FAIL AT

The role of emotion and humour for brands

I often refer to ‘growing up’ in Procter & Gamble. In my final year at Uni I was determined to get a job in Advertising. Shame on me – largely I would say because it looked fun and glamorous. This led to an interview with JW Thompson (now Wunderman Thompson) at their famous 40 Berkely Square location. At that time, JWT were in their absolute pomp – London’s most prestigious ad agency. Like all great brands, there was a mythology and aura to JWT that is completely missing from the industry today. If you have seen Mad Men – my interview was a couple of decades later – but the vibe was exactly that, but more Berkely Square and less Maddison Avenue.

To my huge disappointment, the very prescient manager interviewing me disappointed me in a way I will never forget. He told me he thought I was a good fit, but needed real-world commercial experience. “You should go and work somewhere like Procter & Gamble for a few years and then come back to us.” It wasn’t directly because of that, but that’s exactly what I did – well the first part anyway.

P&G wasn’t really glamorous, but it was disciplined, its brands are relentlessly successful. That is because they follow a formula. Anyone who knows P&G brands will know that they make a wide range of household goods including shampoo, disposable nappies, washing detergents etc. What they all have in common is superior performance, and they are all managed in the same way. P&G only enters a category where it is confident of demonstrably superior product performance, and achieving the number one or two position in the category. They then apply their ruthless distribution and marketing machine to ensure they get there and stay at the top. Brands that can’t or don’t perform adequately are culled or sold. This was especially true of food brands like Folgers coffee and Pringles. Its difficult to prove performance benefits with a food.

But the one thing that eludes P&G – in fact I would say that they deliberately evade as it doesn’t comply well with the formula – is brands that sell mostly on emotional appeal. In my experience possibly the only ever example of P&G successfully doing emotion was actually with humour (itself a huge exception – when did you see a really funny P&G ad?). The product in question was Old Spice. Old Spice had been US brand leader in the deodorant and body wash category, but unusually for P&G, they had failed to progress it. As a result it was largely regarded as outdated and unfashionable and had lost market share. It was on a shortlist to sell.

But in 2010, in what might have felt like a last ditch attempt to re-position that brand, Saatchi & Saatchi created a new ad starring American actor and former footballer Isaiah Mustafa in the now famous ‘Man Your Man Could Smell Like’ ad.

In my recollection it is also the only ever P&G ad (more great ads followed) to go viral and be widely shared on social media (They managed this with P&G’s disastrous foray into ‘toxic masculinity’ with Gillette at the peak of ‘Brand Purpose’ – but for the wrong reasons). But the real proof of effectiveness was in sales. The goal had been to increase sales by 15%. But by May 2010, sales of Old Spice had increased 60% vs. the previous year. By July 2010 they had doubled. (P&G are arch-exponents of ‘The long and the short of it’, so the campaign purpose would have been brand awareness building. This impact on sales both proves the long and short of it theory about brand campaigns capability to drive sales, and was an exceptional result.)

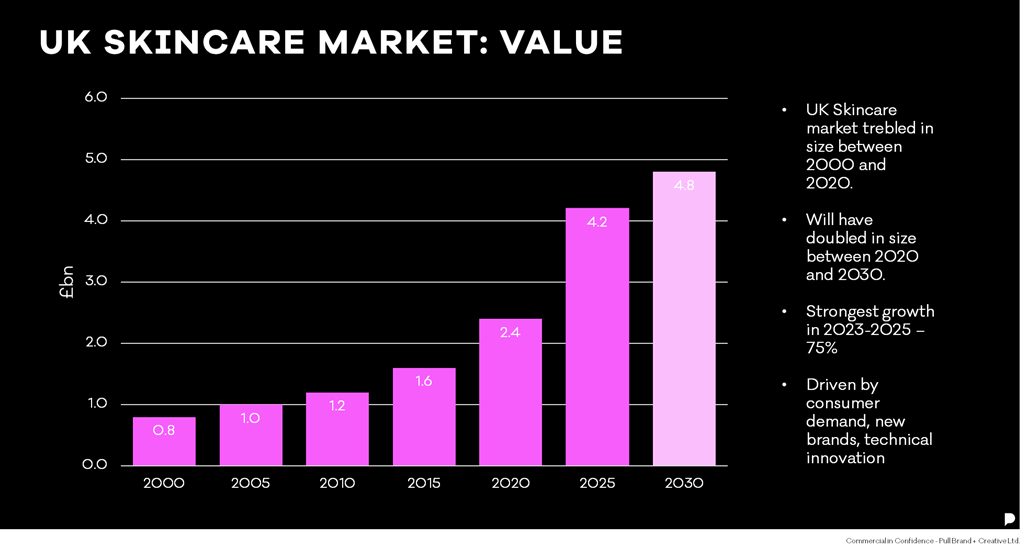

I often reflect on the P&G formula and Old Spice story when working on client’s brands. Pull have done more work in the health and beauty category than any other. But despite this, I feel that we are still uncovering a formula in this space. Nowhere is this more true than in the quite mad category of skincare. The growth in this market – even in the UK’s depressingly declining economy – has been extraordinary. But intriguingly, if you go back far enough, there were not really many brands at all in this category, and they came from the big brand houses of – P&G, Unilever, L’Oréal and Estée Lauder. But these brands haven’t benefited from the extraordinary growth. In fact a P&G insider described their skincare brand Olay recently to me as ‘struggling’ among the endless category atomisation.

It’s also interesting to note – especially since the launch of L’Oréal Luxe and their recent exclusive agreement with the luxury fragrance brand Jacquemus that according to the seminal book The Luxury Strategy:

“Neither L’Oréal, despite its acquisition of Lanvin in the 1990s, nor Procter & Gamble or Unilever have succeeded in the luxury field”.

I think the reasons are somewhat different to how those brand house machines struggle with emotional appeal – but linked. Luxury brand management will be the subject of a future article, but put simply, the luxury marketing model is completely antithetical to the P&G model. It would be very hard to run both under the same roof.

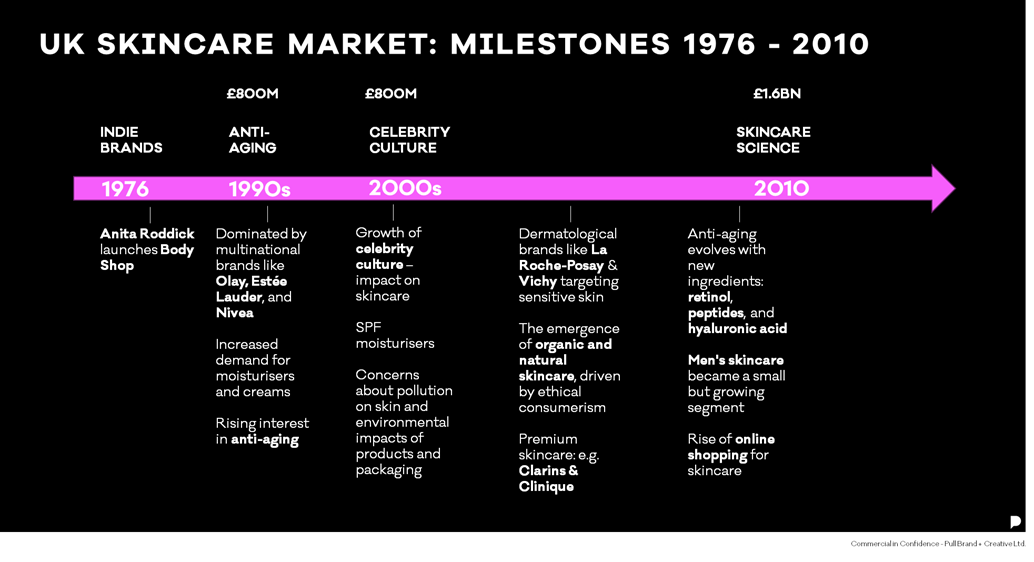

The reality behind the explosive growth in skincare is the plethora of new, independently-owned and often female-founded skincare brands. A revolution arguably started by Anita Roddick in the 1970s.The barriers to entry are relatively low, so the number of new brands exploiting and driving this growth has been huge.

Of course many of these new Indie brands don’t survive. They will go through a precarious set of funding rounds, and even with high levels of exposure and celebrity backers, may still not make it through. One example is TRUE skincare, for which Pull created a brand identity. Despite an appearance on BBC Dragon’s Den

and an offer of investment from 4 out of 5 Dragons, the business sadly went into administration in 2024. The brand lives on, but in new ownership. Probably a bitter pill for founder Emma Thornton.

So something we have been working on at Pull is – in a category where it is next to impossible to demonstrate superior product performance – what are the critical success factors for an Indie skincare brand? We will cover this in the next article. But to give you a clue, part of it is something elusive that will always give the big brand houses a real challenge.

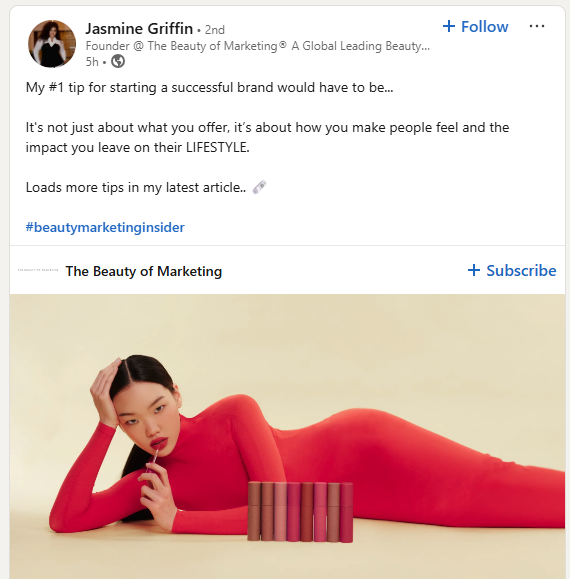

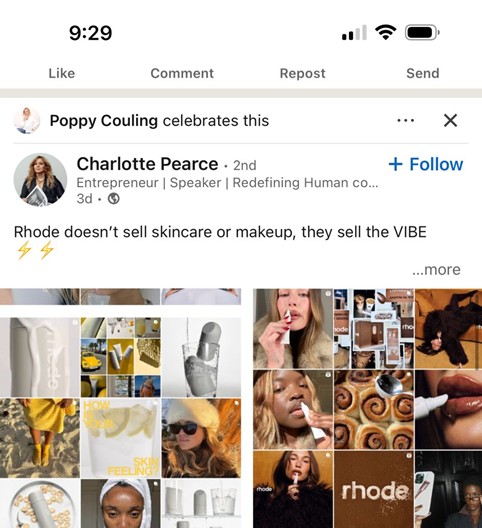

At the end of the day, beauty brands are here not so much to make us beautiful as make us feel good. Thus they need emotional appeal. Successful skincare brands create a VIBE. The buzz around them will create a feelgood factor that they feel impacts on their lifestyle.

Coming next – the 10 critical success factors driving the world’s most successful independent skincare brands.

Posted 9 July 2025 by Chris Bullick